volume_off

volume_up

AACA

America’s Car Club

Enthusiasts • Hobbyists • Collectors

AACA is “America’s Car Club” paving the way in our hobby, celebrating all marques 25 years and older and bringing like-minded car enthusiasts together for a fun and exciting club experience.

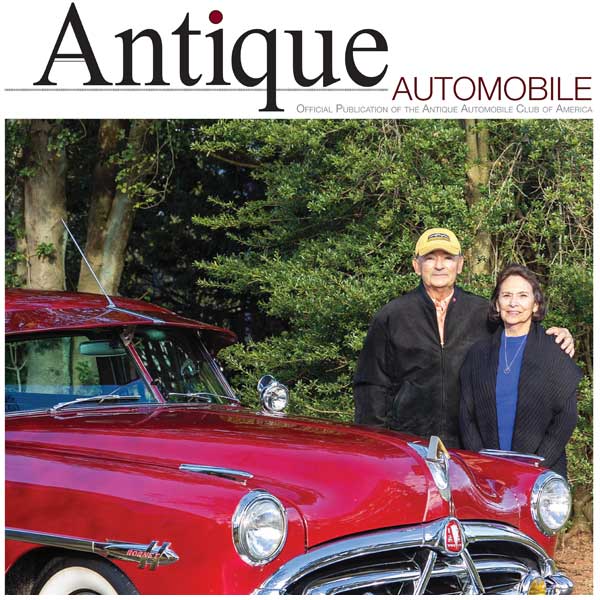

Our well-planned events, seminars, active forums, and unrivaled award-winning print publication complemented by our digital Newsletter Speedster, solidify our position as a leader in the hobby. With over 350 active Regions and Chapters nationwide plus the world’s largest Automotive Archive Library it’s no wonder We’re #1.

Join today and gain access to some of the most knowledgeable, active, and dedicated automotive enthusiasts on the planet.

Special Offer

0

Members Worldwide

0

Regions & Chapters

0

Forum Discussion Threads

0

Technical & Historical Archived Materials & Articles in our Library

BY THE NUMBERS

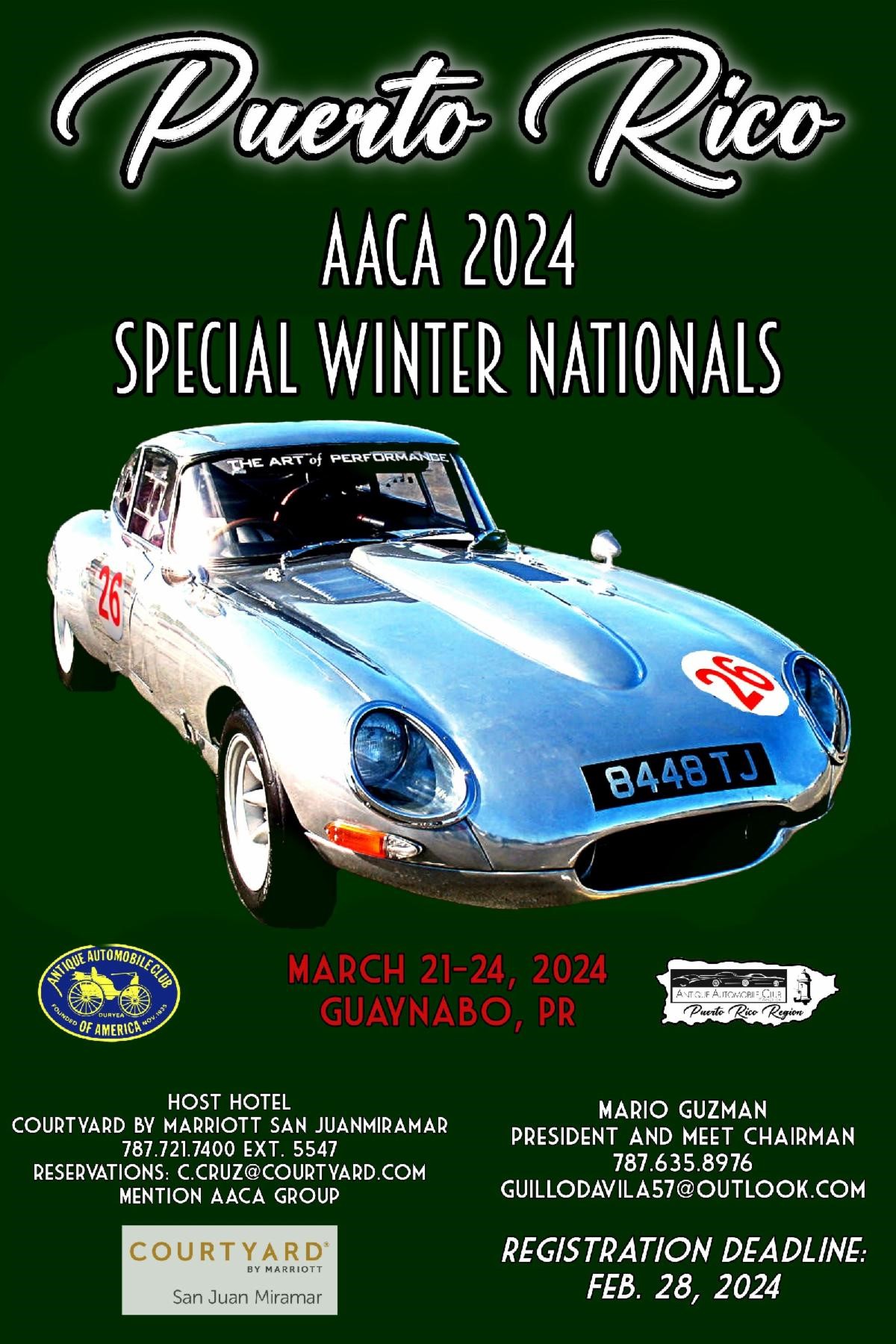

Upcoming Events

AACA bridges that gap and brings everyone together. There’s something for everybody. They’re totally inclusive.

“AACA is the glue that keeps this car hobby together.”

“Hands down the best swap meet in the world.”

Previous

Next

Join America’s Car Club

Cars are EVERYTHING!

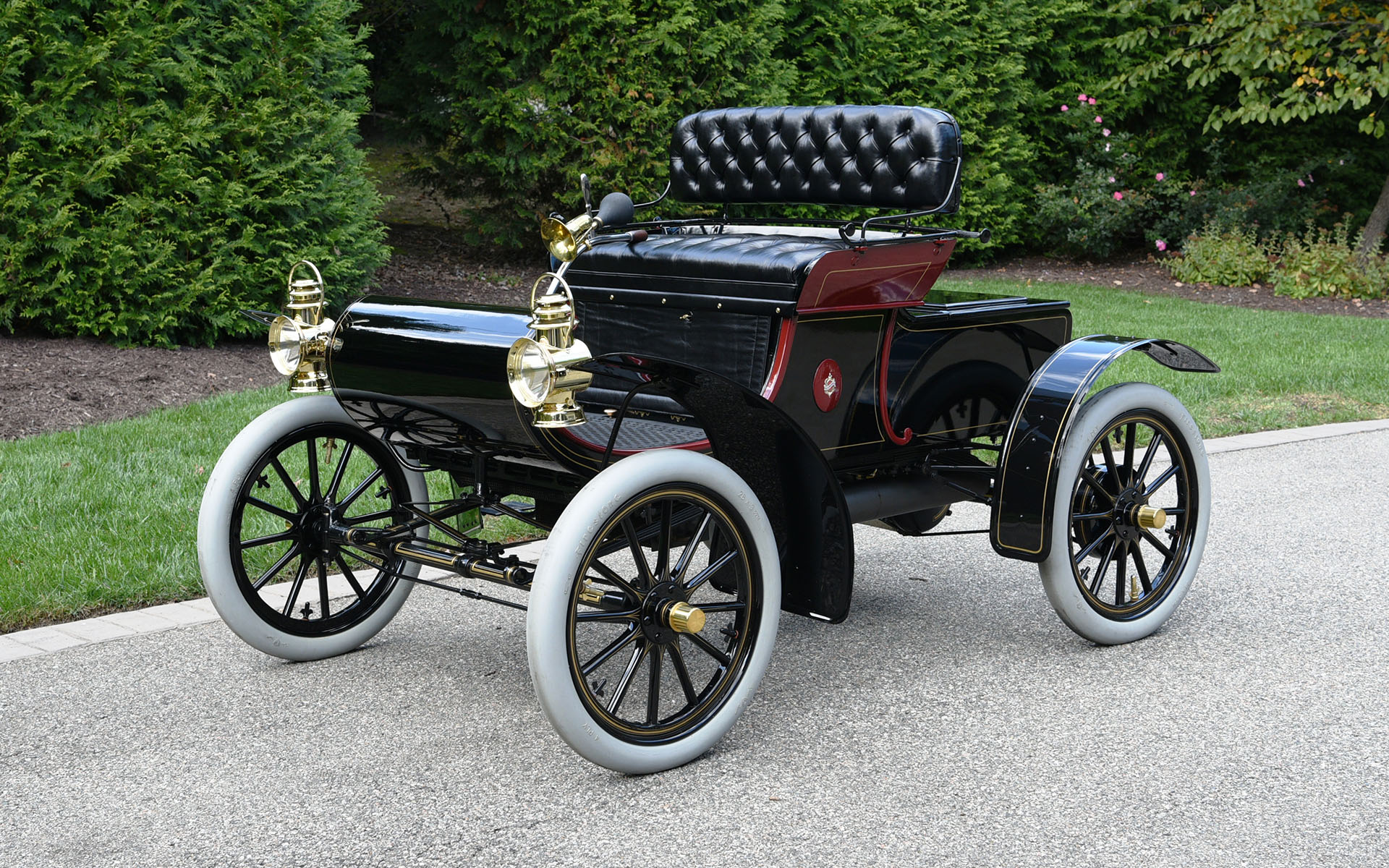

AACA celebrates ANY car that is more than 25 years old.

- Love muscle cars? We do, too.

- Obsessed with ‘60’s, ‘70’s, ‘80’s, ‘90’s? So are we.

- Taken with early iron? We have them but need you.

Join AACA — our knowledgeable, friendly, supportive community is waiting to welcome you.

America’s Automotive Library

The AACA Library & Research Center is one-of-a-kind collection featuring over 3 million technical and historical archived articles, as well as literature, books, journals, artwork, auto manuals and ephemera, periodicals, advertising literature, technical bulletins, photographs, historic license plates, and even cars. Our vast collection of multimedia items includes DVDs, marque films, training film strips, 16mm films, and more. We also have a growing collection of interactive 3D models showcasing how various cars and their components work.

This unparalleled automotive library is open free to the public for individual research.

Welcome car lovers!

Participation Encouraged

Join AACA today, and put your insatiable love of cars into action with our full slate of AACA member benefits:

- Extensive Automotive Library

- National Tours All Over the Country

- Award-Winning Magazine (Distributed Bi-Monthly)

- Forums Covering Thousands of Topics

- Local Regions and Chapters

- Calendar Filled with Conventions, Shows & Events

- Monthly Newsletter — The Speedster

- AACA Judging & Guidelines

3 Ways to Experience AACA

AACA In Person

Join us for a Tour and exercise your car! We plan the entire itinerary for you — scenic stops, hotel accommodations, meals, receptions, and more.

AACA Online

We have 120 forum discussion threads so you can buy, sell, chat, connect, and learn from fellow car enthusiasts from around the world.

AACA at Home

There’s nothing better than joining one of our Local Regions and Chapters and finding your people. After all, car people are the BEST people!

Join AACA TODAY!

Learn more about our 4 great AACA Membership options:

- Annual Membership: $45

- Student Membership: $12

- Lifetime Membership: $700

- Military Membership: Complimentary

Find a Local Chapter

Find the closest AACA Region/Chapter near you with our listing of chapters.

Hop in the car…We’re probably right around the corner!

Keep Current with AACA

The atrium is looking a little bare. Something new is on its way, check back later for the reveal! Let the guessing begin. What do you think or want us to display front and center? #somethingsmissing

The atrium is looking a little bare. Something new is on its way, check back later for the reveal! Let the guessing begin. What do you think or want us to display front and center? #somethingsmissing …

Check out one of our newest displays here at HQ a 1926 Pontiac “Boat Tail” Hillclimb Speedster. First documented race was in August 1926 and it was retired in 1932. #antiquecars #antiqueautomobileclubofamerica #aaca #pontiac #race #car #racecar #hillclimbracing

Check out one of our newest displays here at HQ a 1926 Pontiac “Boat Tail” Hillclimb Speedster. First documented race was in August 1926 and it was retired in 1932. #antiquecars #antiqueautomobileclubofamerica #aaca #pontiac #race #car #racecar #hillclimbracing …

Last week to check out the 1970 Chevrolet Camaro Rally Sport that’s been on display here at HQ. Look for it at the Southeastern Spring Nationals in Charlotte, NC, on Saturday, April 6, before it heads home. #southeasternspringnationals #antiquecarshow #antiquecars #antiqueautomobileclubofamerica #aaca #camaro

Last week to check out the 1970 Chevrolet Camaro Rally Sport that’s been on display here at HQ. Look for it at the Southeastern Spring Nationals in Charlotte, NC, on Saturday, April 6, before it heads home. #southeasternspringnationals #antiquecarshow #antiquecars #antiqueautomobileclubofamerica #aaca #camaro …